The gold market has been on fire this year, with the price of gold rising by 60% driven by concerns over a possible recession in the US, the weaker US dollar, and the prospects of inflation rearing its head on the heels of Trump’s trade war, and the Federal Reserve’s rate normalization. But what about central banks’ role in adding fuel to this already heated bullion market? Also, are US treasuries going out of style in the balance sheets of central banks?

Perhaps you have seen some recent articles that argue that central banks have been purchasing gold, and that too is part of the narrative behind the recent gold bull run. Usually, such articles show a chart of how gold has become the go-to reserve for many central banks, such as this one, this article, or this one, just a few recent examples. Some of them argued that central banks have been favoring gold over US treasuries, as the value of gold reserves has surpassed that of US treasuries.

But I think these articles are somewhat misleading: First, the main reason behind the rise in gold value of these central banks is…well, the higher gold price (dah).

But what about actual gold reserves in tons? Based on the data from the Gold Council, central banks increased their gold holdings, in tons, from Q4 2019 to Q2 2025 by 8.4%, and during the first half of 2025, gold reserves (in tons) of central banks rose by only 0.6%. As the chart in this article shows, most of this increase in tons was in emerging markets and developing countries. So, it’s hard to make the case that this year’s gold rally is due to the enthusiasm of central banks over the precious metal.

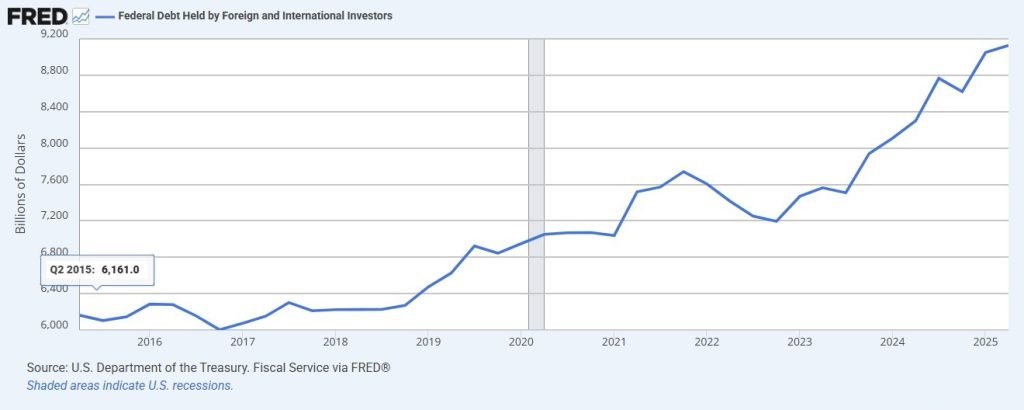

On the other hand, the weaker US dollar against many currencies has contributed to the decline in value of treasuries in central banks’ holdings. But this trend doesn’t suggest a lack of demand. Indeed, as the chart below shows, the foreign holdings of treasuries have been climbing at a steady pace, including in the last few years. While some countries may have scaled down their holdings, such as China, others, including the UK, raised their stakes in treasuries.

Major Foreign Holders of Treasury Securities

Source: FRED

So, while the demand for gold has been rising – as investors seek shelter in these uncertain times – central banks, at least for now, have not been the main culprit behind the recent gold rally, as they are not in a hurry to stock up on precious metal and reduce their treasury holdings.